Category: Crude Oil Intelligence

Kayrros monitoring shows nine units remain idle and are undergoing repairs at the 502,000 b/d Baton Rouge refinery Kayrros monitoring shows nine units remain

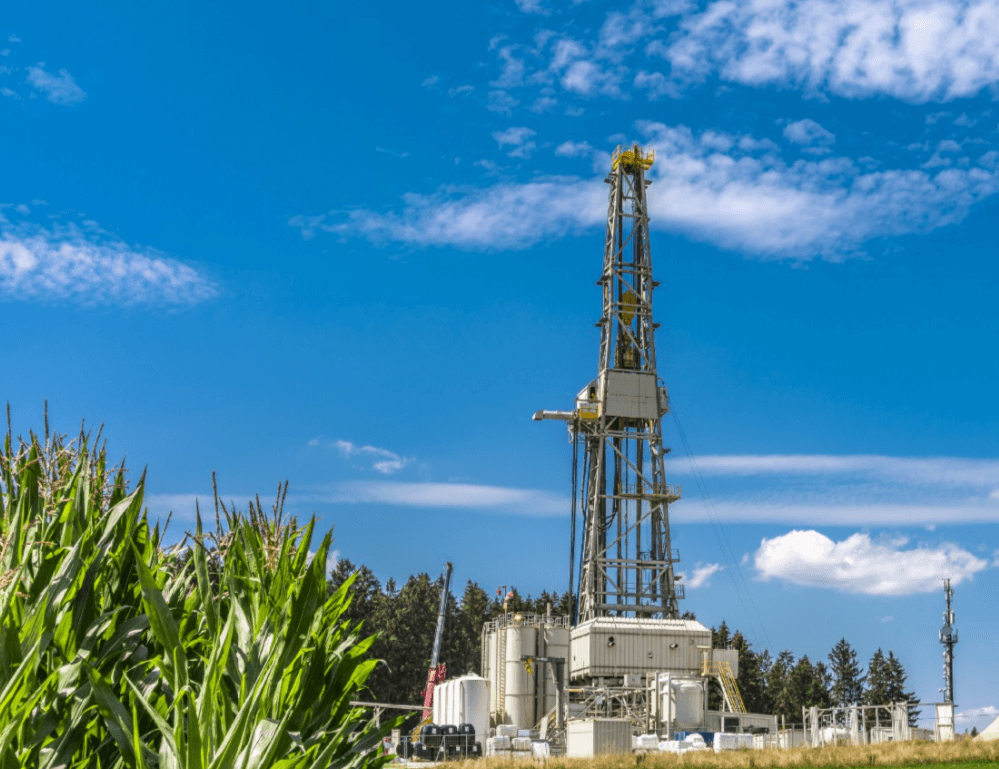

The coronavirus is continuing to take its toll on the Chinese economy, driving oil demand down and shuttering many of the country’s industrial facilities

The corona virus epidemic had already shaved 3 percentage points off of Chinese crude oil demand growth as of end-January, Kayrros oil market monitoring

The idea of a ban on hydraulic fracturing has — perhaps predictably — proved polarizing since being recently aired in the US presidential primary

While the US Energy Information Administration (EIA) has been reporting a drop in the Lower 48 inventory of drilled and uncompleted (DUC) wells in

Last month’s attack on Saudi Arabia’s oil infrastructure was one of the biggest oil supply disruptions ever recorded but the market took it in

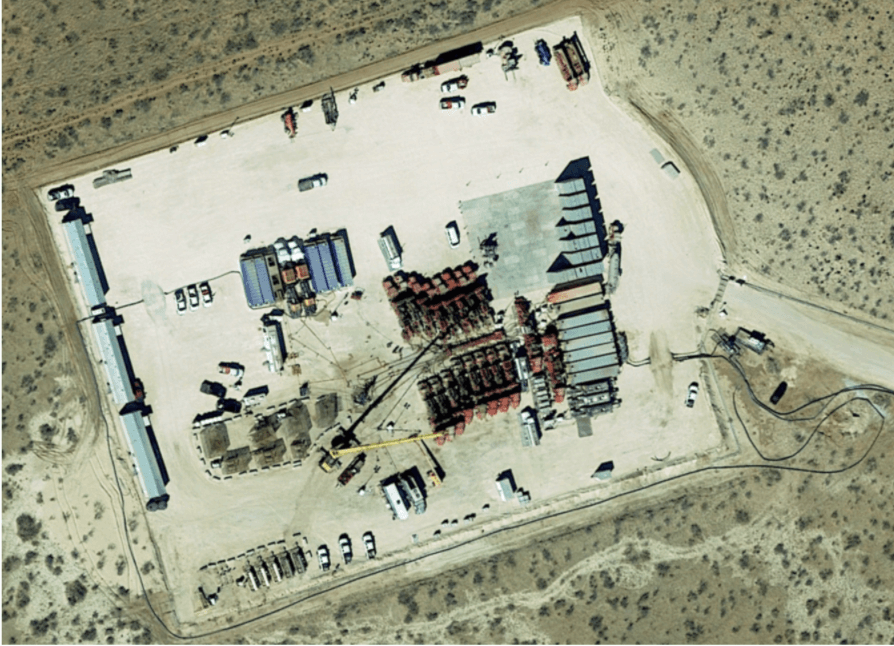

Frac crews in the Permian, the most prolific tight oil basin in the US, plunged by 19% in Q2 2019 year-on-year and 8% from

Using satellite imagery and deep learning to shed light on the blind spots of the US tight oil boom Twenty feet under a Haussmanian

The disconnect between US oil equity and commodity prices has been a feature of the industry since oil markets started healing from their 2014

CATEGORIES

Categories

- 3D Mapping (1)

- Carbon Watch (4)

- Cement (1)

- China Power Watch (1)

- Company (16)

- Crude Oil Intelligence (29)

- Demand (10)

- Emissions (14)

- Events (1)

- Investors (1)

- Jet Fuel Demand (1)

- Kayrros Eye (9)

- LNG (2)

- Methane Watch (2)

- On-Road (3)

- Operations (14)

- Platform (4)

- Powerlines (1)

- Press Release (8)

- Production (16)

- Refineries (7)

- Technology (16)

- Traders (24)

- Uncategorized (2)

- Unclassified (2)

- Wildfire Risk Monitor (1)