Author: Galactic Fed

Using satellite imagery and deep learning to shed light on the blind spots of the US tight oil boom Twenty feet under a Haussmanian

The disconnect between US oil equity and commodity prices has been a feature of the industry since oil markets started healing from their 2014

“If two sentences have exactly the same meaning but no word in common, how do you make a machine understand that they mean the

When macroeconomic concerns cloud the oil market outlook so darkly that even bullish OPEC news fails to stem a selloff as seemed to happen

As OPEC meets on July 1, continued growth in US production may paradoxically no longer be the threat it once was for the producer

Further escalation of geopolitical tensions in the Middle East is raising oil-market concerns over supply risks, even as US sanctions appear to have already

Mixed signals in the run-up to the OPEC meeting: geopolitical risk and backdrop of mounting demand risk. Against this confusing backdrop, market data gathered

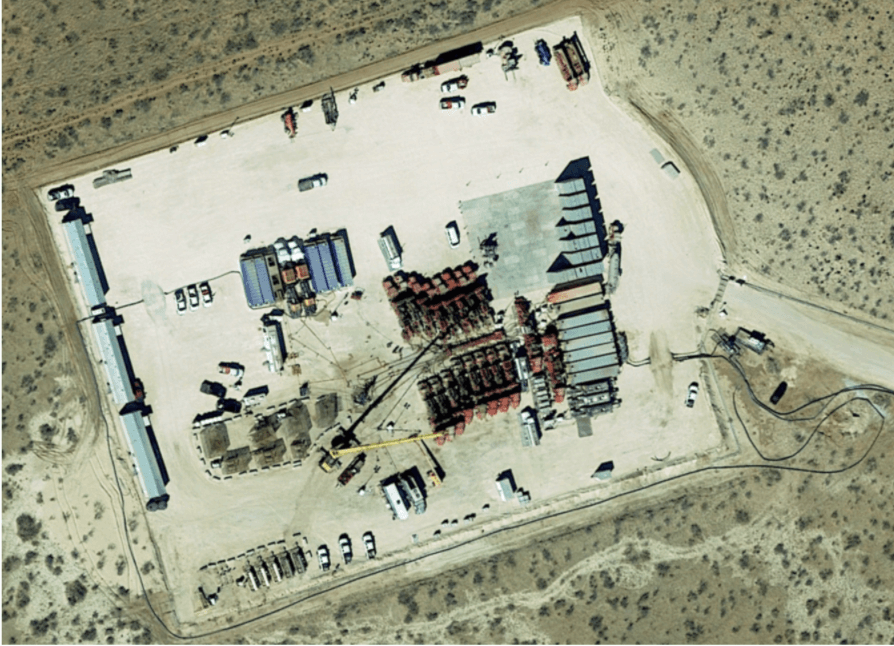

Revolutionary tech gives players a market edge In an industry that lacks a thorough network of public intelligence, satellite imaging generates realtime data on

The current pipeline constraints in the Permian have been caused by the booming production recorded since the crude oil price recovered in mid-2016. While

CATEGORIES

Categories

- 3D Mapping (1)

- Carbon Watch (4)

- Cement (1)

- China Power Watch (1)

- Company (16)

- Crude Oil Intelligence (29)

- Demand (10)

- Emissions (14)

- Events (1)

- Investors (1)

- Jet Fuel Demand (1)

- Kayrros Eye (9)

- LNG (2)

- Methane Watch (2)

- On-Road (3)

- Operations (14)

- Platform (4)

- Powerlines (1)

- Press Release (8)

- Production (16)

- Refineries (7)

- Technology (16)

- Traders (24)

- Uncategorized (2)

- Unclassified (2)

- Wildfire Risk Monitor (1)