Q12022 data raise concerns about greenhouse gas footprint amid calls for higher oil and gas production.

Methane emissions from some of the most prolific U.S. oil, natural gas and coal basins look at risk of significantly increasing in 2022 after bouncing back from Covid lows in 2021, the latest Kayrros basin-level measurements indicate.

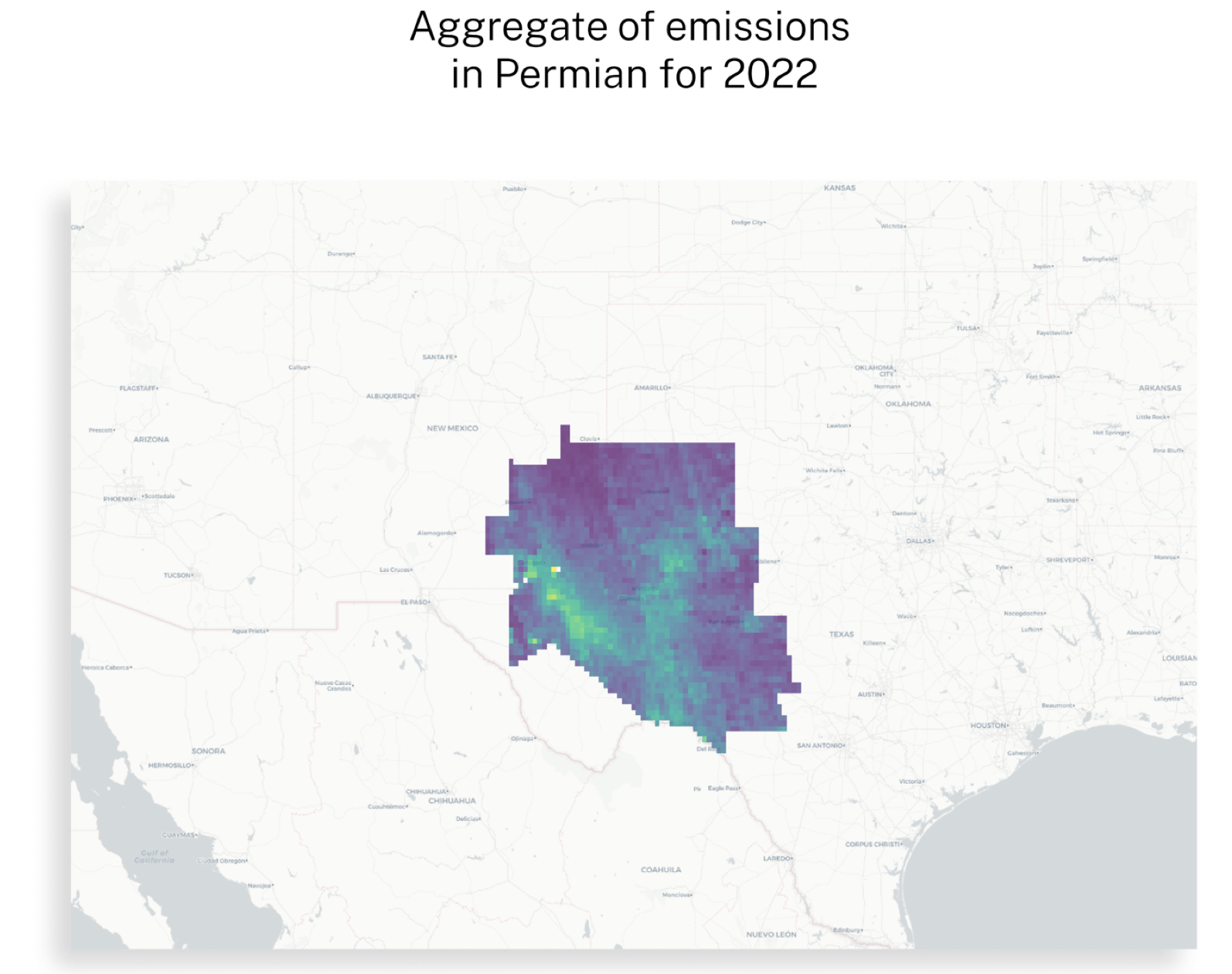

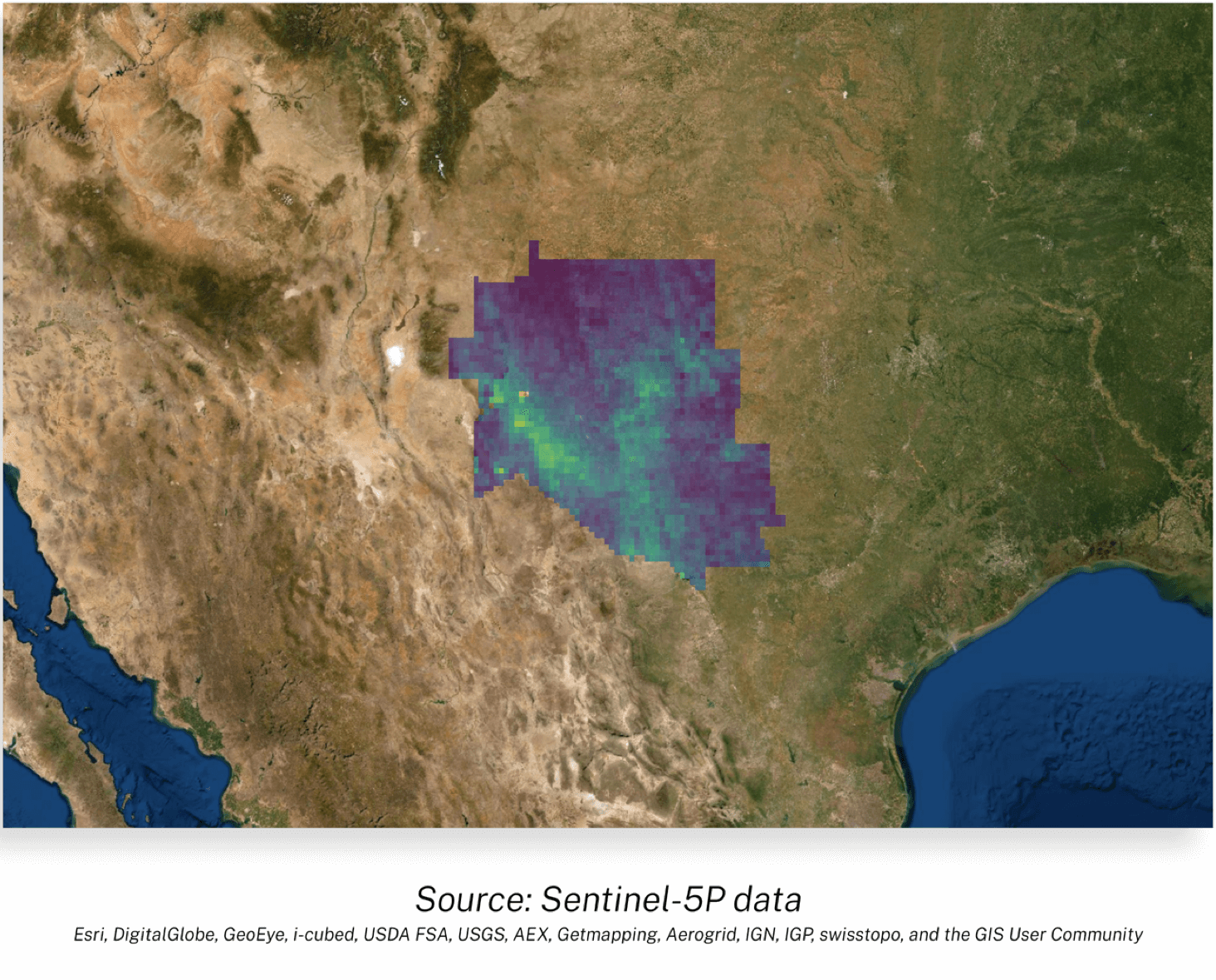

Using its Methane Watch technology, Kayrros has run full inversion models for select oil, natural gas and coal basins historically associated with high methane emissions, including the Permian and Appalachian basins of the U.S., Iraq, Iran, Kuwait, Algeria’s Hassi R’Mel natural gas basin and Turkmenistan. The results provide a comprehensive assessment of emissions from these regions, including both “super-emitters” that can be detected and measured from space as well as smaller leaks that may not register individually on satellite imagery but whose cumulative impact over time is measurable. The fifindings for FY2021 and Q12022 are worrisome:

- In the Permian basin, the most prolific U.S. oilfield, preliminary data show methane emissions jumped by about one third in the first quarter of 2022 from the previous quarter and by nearly half year-on-year, averaging about 15% above pre-Covid levels. The basin had achieved substantial reductions in methane intensity in 2020 amid small average production gains, but emissions started bouncing back and ran ahead of supply in 2021. The increase gained momentum in Q1 2022 and looks at risk of accelerating further as drilling and frac’ing activity respond to high oil and gas prices and calls for more production.

- The Marcellus & Utica basins, two prolifific shale gas plays in the Appalachian, offer a similar story. Emissions fell steeply in 2020 despite a small average gain in natural gas production, but started retracing their decline in 2021. The methane intensity of Appalachian gas reached its highest level in Q12022 since Q3 2020.

- In the Appalachian coal sector, the situation is even more concerning. When production from Appalachian coal mines fell in 2020 amid lower demand due to Covid-19, methane emissions were slower to decline. But as production started to bounce back in 2021, emissions grew faster. The rising methane intensity of Appalachian coal production means that its contribution to climate change has steadily increased even as its contribution to power generation has declined.

- In total, emissions from the Permian, Appalachian and Anadarko fossil fuel basins, accounting for a large share of total US onshore production, reached their highest level in three years in Q12022, extending 2021 gains, while signs of rebounding oil and gas fifield activity suggest even faster emission gains might be on the cards for the remainder of 2022.

-

Outside of the U.S., methane emissions were a mixed bag in 2021, with steep increases in Turkmenistan and Algeria’s top gas producing basin, but apparent declines in both absolute emissions levels and methane intensity in Kuwait and Iran compared to 2019 levels. In Iraq, emissions followed production lower in 2020 but bounced back with it in 2021.

The latest gains in the U.S. occur despite growing awareness of the urgent need for methane abatement and of the opportunity for large emission cuts provided by the fossil-fuel sector. In November 2021, the U.S. Government joined the European Commission in launching the Global Methane Pledge at COP26 in Glasgow. The pledge’s 110 signatory nations commited to cut methane emissions by 30% by 2030 from 2020 levels. The U.S. Environmental Protection Agency will soon release new methane rules to that effect.

The reversal of earlier reductions in U.S. methane emissions from fossil fuels is of concern at a time when tight energy markets and high fuel prices following Russia’s invasion of Ukraine have prompted mounting calls for more U.S. oil and gas supply.

While it’s only six months since the launch of the Global Methane Pledge, the overall trend in global methane emissions so far appears to be going in the wrong direction, as evidenced by recent developments in these major producer countries. Given the high warming power of methane — more than 80 times than of carbon dioxide in the fifirst 20 years — and the short window available to signifificantly reduce emissions, the lack of progress achieved so far is a concern.

Read the full report here.