Kategorie: Crude Oil Intelligence

Following the Biden Administration’s decision to halt new oil and gas leasing activities across federal lands and offshore waters pending the outcome of a

COVID-19 at its peak caused the steepest demand drop in oil history, albeit with stark differences across fuel types and sectors of economic activity.

Roughly a year after the oil shock of COVID-19 – marked by collapsing demand, surging inventories, heroic supply cuts — the question before us

The global oil industry has been doubly hit by the COVID-19 pandemic: by the collapse in oil demand triggered by the lockdowns and by

The oil market was shaken to its core when NYMEX WTI prompt contract prices, for the first time in history, fell into negative territory.

China and its neighboring Asian countries are exhibiting different crude demand profiles just a few months after the first cases of coronavirus Implied crude

The back-to-back OPEC+ and G20 meetings resulted in the largest (in volume) and broadest (in participants) production cut deal in oil history and seem

The corona virus outbreak is impacting energy demand in the world’s most populous countries, China and India, on different timescales China was the first

Perhaps for the first time in its history, the oil market is about to test storage capacity limits Perhaps for the first time in

CATEGORIES

Kategorien

- 3D Mapping (1)

- Carbon Watch (4)

- Cement (1)

- China Power Watch (1)

- Unternehmen (16)

- Crude Oil Intelligence (29)

- Demand (10)

- Emissions (14)

- Events (1)

- Investoren (1)

- Jet Fuel Demand (1)

- Kayrros Eye (9)

- LNG (2)

- Methan-Überwachung (2)

- On-Road (3)

- Operations (14)

- Plattform (4)

- Powerlines (1)

- Pressemitteilung (8)

- Production (16)

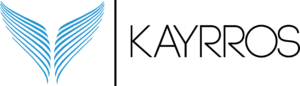

- Refineries (7)

- Technologie (16)

- Trader (24)

- Uncategorized (2)

- Unclassified (2)

- Wildfire Risk Monitor (1)