Roughly a year after the oil shock of COVID-19 – marked by collapsing demand, surging inventories, heroic supply cuts — the question before us is, are oil markets headed for recovery or transformation? In the face of so much uncertainty, present market conditions have never been more transparent. For the first time, new data tools let participants keep track of the markets in real-time. This new transparency about the present offers some valuable insights into the future. Here are a few of them.

Crude inventories: Are high stocks here to stay?

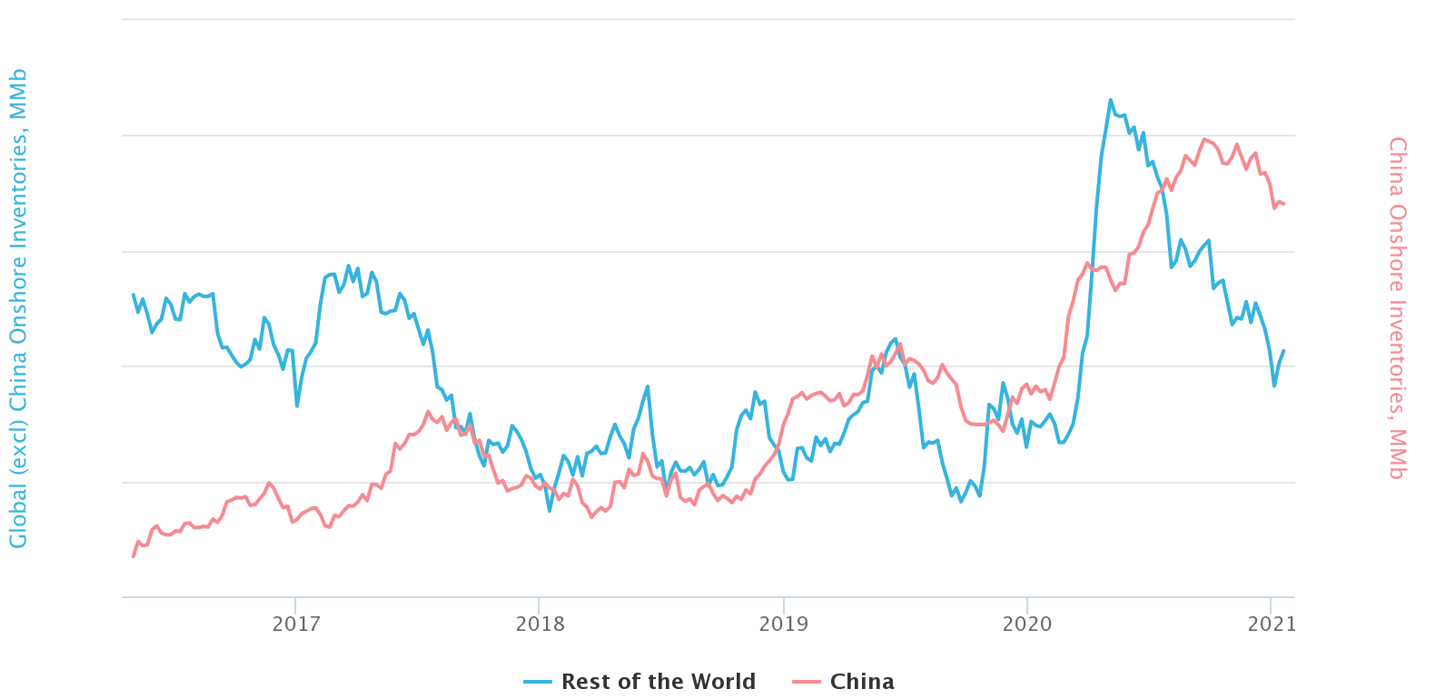

Few visuals capture the oil market impact of the pandemic better than the 300-million barrel surge in oil inventories in March-April of last year, at the peak of the lockdowns. Roughly a year later, oil prices are back to pre-pandemic levels, but crude stocks remain elevated, some 170 million barrels above pre-COVID-levels. Have prices and inventories diverged, potentially setting the stage for a market correction, or have stocks just rebased at a higher level, and should we consider today’s elevated inventory levels the new normal?

Satellite observations suggest that the COVID-19 pandemic may have helped accelerate a rebasing of global crude inventories.

On the face of it, the market looks hopelessly oversupplied (Figure 1). On closer look, the overhang is mostly in China. Ex-China, the world has broadly come back into balance. Large consumers, having steadily chipped at their inventories, are back to pre-COVID levels. (Figure 2). In APAC, this equilibrium was reached in November. Inventories in Europe are now back to lows seen in early 2020. In North America, inventories returned to pre-COVID levels in October.

Chinese stocks first built during the Chinese lockdowns, then moved sideways as China came out of confinement

Chinese stocks first built during the Chinese lockdowns, then moved sideways as China came out of confinement while the rest of the world remained shuttered. Soon Chinese inventories rose even faster and for a more sustained period of time than during the initial climb. Whereas the first phase of China’s builds was demand-driven, in the second phase supply led by way of a surge in imports: China effectively served as a sink for the world’s excess production at a time when other consumers cut back on imports and started drawing down inflated inventories.

In effect, the COVID-19 pandemic helped accelerate a structural surge in Chinese crude inventories made possible by a steep expansion of storage capacity. This capacity increase enabled Chinese importers to take advantage of the price collapse and go on a price-opportunistic shopping spree.

Several additional factors appear to have played a role in the Chinese builds. In the wake of the Sino-US trade war, Beijing found renewed value in energy security and import independence, and the Chinese leadership openly encouraged investment in domestic production capacity and precautionary stocks. Refining capacity also increased, and with the help of new storage tanks helped raise minimum operating levels. The combination of these factors translated into stronger demand for storage and higher market tolerance for historically high stocks — in effect resetting the baseline of inventories at a higher level.

This does not mean that Chinese stocks will never go down again but rather that any fall back from today’s elevated levels will likely be more bullish for prices than would have been the case in the past. Indeed, the resumption of Chinese stock draws has helped lift oil prices in recent weeks.

Ironically, the last few months have shown that a drop in demand does not necessarily reduce the need for demand cover. Under normal circumstances, lower demand means less demand for cover. Since the COVID-19 pandemic, however, the opposite seems to have happened: expansions of both refining and storage capacity in China, economic deglobalization and international tensions combined with a market crash that lowered storage acquisition costs spurred Chinese demand for storage, leading to a massive expansion of Chinese crude inventories. The center of gravity of oil inventories has continued its eastward slide even as the baseline of ‘normal’ inventories has increased.

This is a sanitized excerpt of a larger report sent to Kayrros subscribers. Click ici to request a trial of Kayrros Crude Oil Intelligence.