Catégorie : Traders

The global oil industry has been doubly hit by the COVID-19 pandemic: by the collapse in oil demand triggered by the lockdowns and by

The oil market was shaken to its core when NYMEX WTI prompt contract prices, for the first time in history, fell into negative territory.

Too little too late: US tight oil activity plummets in March, but not enough to prevent a historic crash in WTI In the wake

The back-to-back OPEC+ and G20 meetings resulted in the largest (in volume) and broadest (in participants) production cut deal in oil history and seem

The corona virus outbreak is impacting energy demand in the world’s most populous countries, China and India, on different timescales China was the first

The idea of a ban on hydraulic fracturing has — perhaps predictably — proved polarizing since being recently aired in the US presidential primary

While the US Energy Information Administration (EIA) has been reporting a drop in the Lower 48 inventory of drilled and uncompleted (DUC) wells in

Last month’s attack on Saudi Arabia’s oil infrastructure was one of the biggest oil supply disruptions ever recorded but the market took it in

As OPEC meets on July 1, continued growth in US production may paradoxically no longer be the threat it once was for the producer

CATEGORIES

Catégories

- 3D Mapping (1)

- Carbon Watch (4)

- Cement (1)

- China Power Watch (1)

- Entreprise (16)

- Crude Oil Intelligence (29)

- Demand (10)

- Emissions (14)

- Events (1)

- Investisseurs (1)

- Jet Fuel Demand (1)

- Kayrros Eye (9)

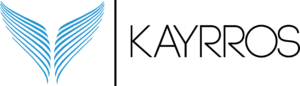

- LNG (2)

- Methane Watch (2)

- On-Road (3)

- Operations (14)

- Plateforme (4)

- Powerlines (1)

- Communiqué de presse (8)

- Production (16)

- Refineries (7)

- Technologie (16)

- Traders (24)

- Uncategorized (2)

- Unclassified (2)

- Wildfire Risk Monitor (1)