Discover Kayrros ERCOT Impact Monitor at ERCOT Market Summit ➝ Get the most timely and accurate information on capacity additions to the grid, with cutting-edge satellite imagery and AI.

///

Make better decisions on

energy and the environment

Kayrros satellite-based technology independently measures the footprint of human activity on the environment at a global level

///

Science, AI and realtime satellite imagery transform global climate governance

///

Kayrros serves industries that need independent, accurate and reliable intelligence to succeed

///

Proprietary algorithms deliver accurate and actionable data streams at the lowest possible cost

Accuracy

Coverage

Largest mapped database of

millions of industry assets and

natural ecosystems

Value

Accuracy

Coverage

Largest mapped database of

millions of industry assets and

natural ecosystems

Value

///

///

///

Kayrros Carbon Watch introduces EU carbon emissions forecasts

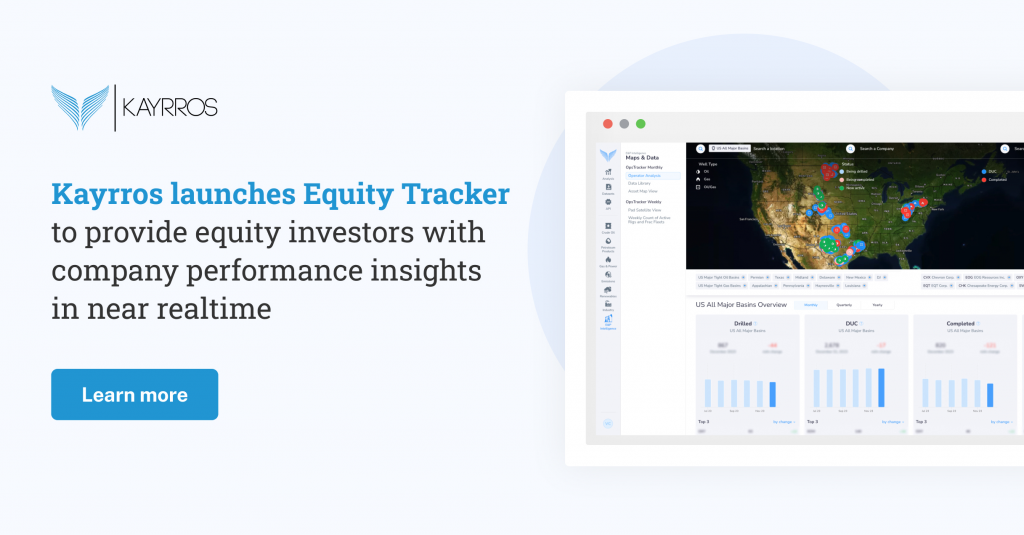

Kayrros launches Equity Tracker to provide equity investors with company performance insights in near realtime

KAPSARC and Kayrros Unveil Saudi Arabia’s Methane Emission Landscape Using Satellite Technology

Global Methane Pledge signatories failing in bid to cut emissions by 30% by 2030, Kayrros data shows